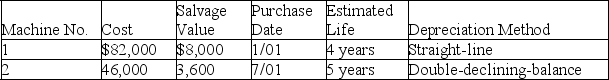

A company's property records revealed the following information about its plant assets:

Calculate the depreciation expense for each machine in Year 1 and Year 2 for the year ended December 31.

Calculate the depreciation expense for each machine in Year 1 and Year 2 for the year ended December 31.

Machine 1:

Year 1________ Year 2 ________

Machine 2:

Year 1 ________ Year 2 ________

Definitions:

Pretax

Financial figures or earnings calculated before taxes are deducted.

Distribution

The process of allocating or dispersing goods, resources, or payments to various parties.

Scores

A numerical representation of an individual's creditworthiness or other evaluated attributes, often used in assessing financial and sports performances.

Quiz

A test of knowledge, especially a brief, informal test given in educational settings.

Q77: A company using the percentage of sales

Q82: Hunter Sailing Company exchanged an old sailboat

Q94: The expense recognition (matching)principle is used to

Q141: On January 1,a company issues 8%,5-year,$300,000 bonds

Q149: On January 1,a company issues 6%,10 year

Q167: _ reflects the liquidity of a company's

Q182: On January 1,Year 1,Stratton Company borrowed $100,000

Q185: Times interest earned is calculated by:<br>A)Multiplying interest

Q188: The internal document prepared by a department

Q192: Companies follow both the expense recognition (matching)principle