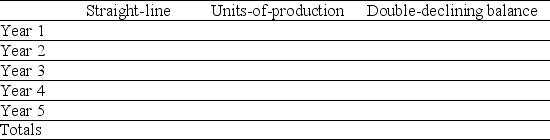

A company purchased a machine on January 1 of the current year for $750,000.Calculate the annual depreciation expense for each year of the machine's life (estimated at 5 years or 20,000 hours,with a salvage value of $75,000)using each of the below-mentioned methods.During the machine's 5-year life its hourly usage was: 3,000; 4,000; 5,000; 5,000; and 3,000 hours.

Definitions:

Key Dates

Critical milestones within a project timeline that indicate important deadlines or events which could affect the project's overall schedule and success.

Electronic Communication

The transfer of information using electronic means such as email, text messages, and social media platforms.

Major Stakeholders

Primary or key individuals or groups with a significant interest or stake in the outcome of a project, whose engagement is crucial for the project's success.

Management Skills

The abilities and competencies that an individual needs to manage people, projects, or tasks effectively within an organization.

Q25: MacKenzie Company sold $300 of merchandise to

Q26: At the end of the current period,a

Q69: Fields Company purchased equipment on January 1

Q72: Separate accounts receivable information for each customer

Q100: Return on equity increases when the expected

Q104: Minor Company installs a machine in its

Q120: Majesty Productions accepted a $7,200,120-day,6% note from

Q139: A company has $80,000 in outstanding accounts

Q150: On June 20 of the prior year,a

Q156: Jervis accepts all major bank credit cards,including