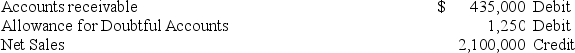

The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bad debts expense.  All sales are made on credit.Based on past experience,the company estimates 1% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit.Based on past experience,the company estimates 1% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

Definitions:

Utilization Review

A health care quality assurance activity that assesses the necessity, appropriateness, and efficiency of the use of health care services, procedures, and facilities.

Managed Care

A healthcare system that integrates the delivery and financing of healthcare services to improve quality and control costs.

Therapeutic Intervention

Any action taken by therapists or counselors designed to help clients solve problems, overcome challenges, or achieve improvement in their mental health, behavior, or emotional well-being.

Confidential Information

Sensitive information not to be disclosed to unauthorized individuals, to protect privacy or proprietary interests.

Q58: Jervis sells $75,000 of its accounts receivable

Q66: In the process of reconciling its bank

Q78: When the maker of a note is

Q84: The FIFO inventory method assumes that costs

Q131: Explain the options a company may use

Q132: The quality of receivables refers to:<br>A)The creditworthiness

Q179: Kenai Company sold $600 of merchandise to

Q195: Underwood had cost of goods sold of

Q211: When posting a dishonored note to a

Q248: A benefit of using an accelerated depreciation