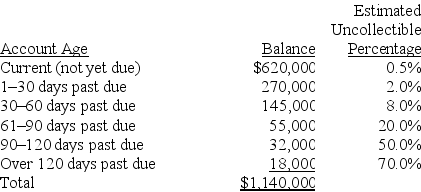

A company uses the aging of accounts receivable method to estimate its bad debts expense.On December 31 of the current year an aging analysis of accounts receivable revealed the following:

Required:

Required:

a.Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet.

b.Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement,assuming that the balance of the Allowance for Doubtful Accounts on January 1 of the current year was $41,000 and that accounts receivable written off during the current year totaled $43,200.

c.Prepare the adjusting entry to record bad debts expense on December 31 of the current year.

d.Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31.

Definitions:

Departmental Overhead Rates

The overhead costs charged to specific departments based on their respective activities or consumption of resources.

Machine Hours

The total number of hours that machinery is operating during a certain period, often used in costing and operational efficiency analysis.

Oak Paneling

Decorative interior panels made from oak wood, often used in furniture, flooring, and wall covering.

Departmental Overhead Rates

The allocation of indirect costs to specific departments based on relevant cost drivers, aiding in more accurate product costing and pricing decisions.

Q8: A company factored $30,000 of its accounts

Q9: The overstatement of the beginning inventory balance

Q64: An advantage of FIFO is that it

Q83: Norman Co.had $5,925 million in sales and

Q124: All of the following are true of

Q126: As long as a company accurately records

Q142: The advantage of the allowance method of

Q149: Starlight Company has inventory of 8 units

Q166: A company's employees had the following earnings

Q223: The phrase capital-intensive refers to companies with