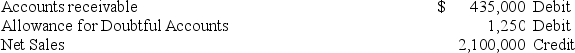

The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bad debts expense.  All sales are made on credit.Based on past experience,the company estimates 1% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit.Based on past experience,the company estimates 1% of credit sales to be uncollectible.What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

Definitions:

Sole General Partner

is an individual or entity that is the only general partner in a partnership, responsible for the management of the partnership and personally liable for its debts.

Limited Partnership

A form of business partnership where there is at least one general partner liable for the debts of the business and one or more limited partners whose liability is limited to their investment.

Corporation

A legal entity that is separate and distinct from its owners, established to conduct business or engage in activities, with the ability to own assets, incur liabilities, and sell shares.

Certificate of Limited Partnership

A legal document filed with a state governmental body to form a limited partnership, outlining the rights and obligations of each partner.

Q4: On October 12 of the current year,a

Q12: Lima Enterprises purchased a depreciable asset for

Q40: All of the following statements related to

Q92: A company sells garden hoses and uses

Q100: When using the allowance method of accounting

Q119: The _ account is used to record

Q127: At December 31,Yarrow Company reports the

Q174: Principles of internal control include all of

Q186: Cash equivalents are short-term highly liquid investment

Q192: Plenty Co.established a petty cash fund of