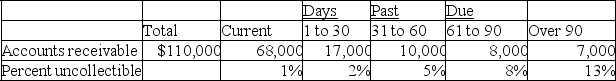

Bonita Company estimates uncollectible accounts using the allowance method at December 31.It prepared the following aging of receivables analysis.

a.Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method.

a.Estimate the balance of the Allowance for Doubtful Accounts using the aging of accounts receivable method.

b.Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a.Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $550 credit.

c.Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a.Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $300 debit.

Definitions:

Interest Payments

The regular payments made to lenders as compensation for the money borrowed, typically expressed as a percentage of the principal sum.

Debt Ceiling

A limit on the total amount of money the federal government can legally borrow.

Defense Spending

Government expenditure on military and defense-related activities, including salaries, equipment, operations, and research and development.

Budget Deficit

A financial situation where a government's expenditures exceed its revenues over a specified period, leading to borrowing or debt accumulation.

Q22: Which of the following inventory costing methods

Q26: If a period-end inventory amount is reported

Q40: Managers place a high priority on internal

Q54: The Petty Cash account is a separate

Q91: The amount due on the maturity date

Q135: Marlow Company purchased a point of sale

Q162: Hull Company reported the following income statement

Q224: The gross margin ratio is defined as

Q248: A benefit of using an accelerated depreciation

Q255: The double-declining-balance method is applied by (1)computing