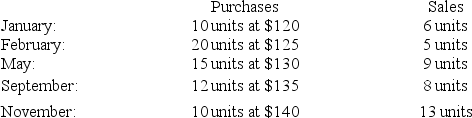

A company had the following purchases and sales during its first year of operations:  On December 31,there were 26 units remaining in ending inventory.Using the Perpetual FIFO inventory valuation method,what is the cost of the ending inventory? (Assume all sales were made on the last day of the month.)

On December 31,there were 26 units remaining in ending inventory.Using the Perpetual FIFO inventory valuation method,what is the cost of the ending inventory? (Assume all sales were made on the last day of the month.)

Definitions:

Self-Presentational Motivation

The drive to control the impressions others form about oneself.

Outcome Expectancies

Beliefs about the consequences or outcomes of performing a behavior, which can influence decision-making and actions.

Self-Efficacy

Self-efficacy refers to an individual's belief in their capacity to execute behaviors necessary to produce specific performance attainments.

Social Anxiety

The fear of social situations that involve interaction with other people, often driven by the fear of being judged or embarrassed.

Q31: A company must disclose any change in

Q107: Explain the reason a company might use

Q110: An inventory error is sometimes said to

Q165: An understatement of the ending inventory balance

Q172: A company had the following items and

Q191: The expense recognition (matching)principle permits the use

Q198: Which of the following is an accounting

Q204: The inventory valuation method that tends to

Q215: A company had beginning inventory of 10

Q239: The acid-test ratio:<br>A)Is also called the quick