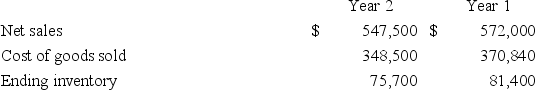

Use the following information for Ephron Company to compute days' sales in inventory for Year 2.(Use 365 days in a year.)

Definitions:

Overhead Costs

Indirect costs not directly traceable to a specific product or service, including utilities, rent, and managerial salaries.

Activity Rate

An activity rate is the cost driver rate used in activity-based costing to allocate overhead costs to products or services.

Activity-based Costing

An accounting method that assigns costs to products or services based on the activities and resources that go into their production, providing more accurate cost information.

Resource Consumption

The use of resources (such as raw materials, energy, or labor) by a process, project, or activity, typically measured to manage efficiency and costs.

Q3: On September 12,Vander Company sold merchandise

Q12: Buffalo Company reported a December 31 ending

Q96: In its first year of business,Borden

Q107: Under the net method,when a company uses

Q120: On September 12,Ryan Company sold merchandise

Q200: A company had a gross profit of

Q218: A company's post-closing trial balance has total

Q257: The Merchandise Inventory account balance at the

Q267: A company has net sales of $825,000

Q352: Accrued revenues at the end of one