Based on the unadjusted trial balance for Highlight Styling and the adjusting information given below,prepare the adjusting journal entries for Highlight Styling.

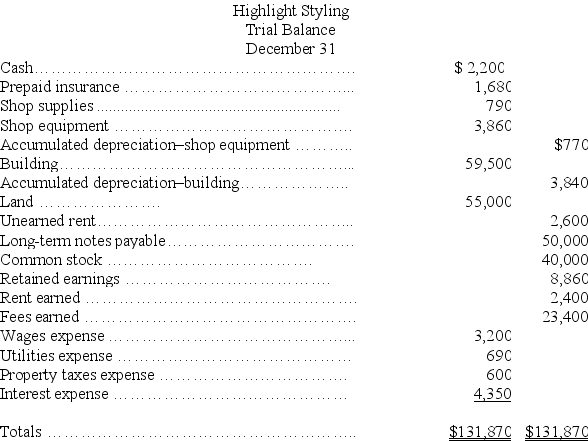

Highlight Stylings' unadjusted trial balance for the current year follows:

Additional information:

Additional information:

a.An insurance policy examination showed $1,040 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,020.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was still unearned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Definitions:

AIDA Format

A marketing model that stands for Attention, Interest, Desire, and Action, used to guide the content of advertising and marketing materials.

Application Letter

A cover letter that goes along with a résumé, explaining to the recipient what is being sent, the purpose behind sending it, and the advantages they can gain by reviewing it.

AIDA Plan

A marketing strategy model that stands for Attention, Interest, Desire, and Action, used to guide advertising and sales tactics.

Application Letter

A document sent with one's resume to provide additional information on one's skills and experience, typically for a job application.

Q6: Dividends always decrease equity.

Q15: Use the information in the adjusted trial

Q42: Identify and explain the key components of

Q55: Depreciation measures the decline in market value

Q70: Revenue and expense accounts are permanent (real)accounts

Q84: On September 1,Kennedy Company loaned $100,000,at 12%

Q102: A classified balance sheet organizes assets and

Q173: Describe the key attributes of inventory for

Q199: Interim financial statements report a company's business

Q210: A company's ledger is:<br>A)A record containing increases