Based on the unadjusted trial balance for Glow Styling and the adjusting information given below,prepare the adjusting journal entries for Glow Styling.After completing the adjusting entries,prepare the trial balance for Glow Styling.

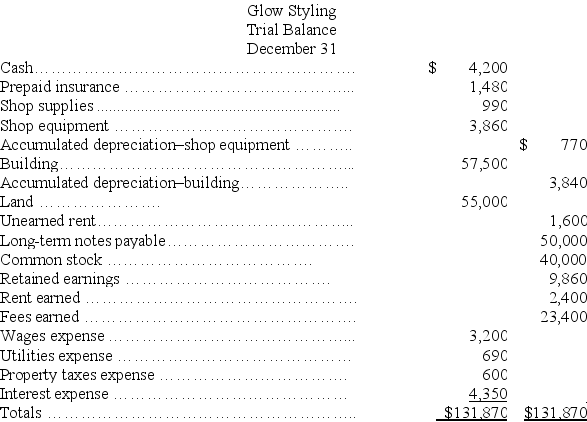

Glow Styling unadjusted trial balance for the current year follows:

Additional information:

Additional information:

a.An insurance policy examination showed $1,240 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,220.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was earned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Use the above information to prepare the adjusted trial balance for Glow Styling.

Definitions:

Planning

The process of setting objectives and determining how to accomplish them.

Control Process

The systematic effort within an organization to guide activities towards meeting goals and objectives, typically involving establishment, monitoring, and adjusting of standards.

Performance Objectives

Specific goals and targets set for employees or departments to achieve, linked to the overall strategic objectives of an organization.

Secure Adequate Financing

The act of obtaining sufficient funds or capital necessary to support operations, projects, or investments.

Q9: Accounting is an information and measurement system

Q39: According to the measurement (cost)principle,it is necessary

Q85: List the four steps in recording transactions.

Q132: Prentice Company had cash sales of $94,275,credit

Q182: High Step Shoes had annual revenues of

Q212: All of the following are classified as

Q223: The ordering of accounts in a trial

Q283: Financial statements can be prepared directly from

Q324: What is the purpose of closing entries?

Q368: Under the cash basis of accounting,no adjustments