Based on the unadjusted trial balance for Glow Styling and the adjusting information given below,prepare the adjusting journal entries for Glow Styling.After completing the adjusting entries,prepare the trial balance for Glow Styling.

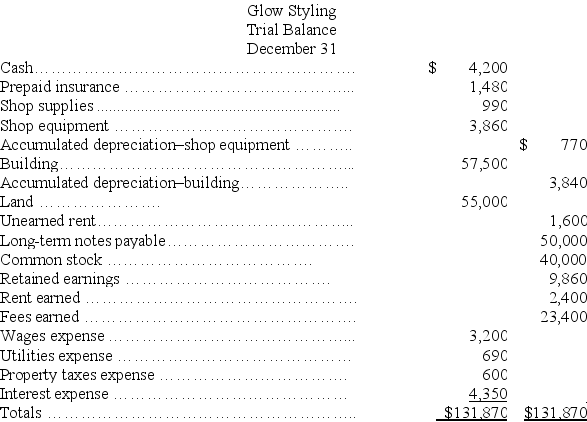

Glow Styling unadjusted trial balance for the current year follows:

Additional information:

Additional information:

a.An insurance policy examination showed $1,240 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,220.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was earned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Use the above information to prepare the adjusted trial balance for Glow Styling.

Definitions:

Silverback Gorilla

A mature, male gorilla, known for its distinct silver-colored hair on its back, signifying leadership and strength in a gorilla group.

Family Hierarchy

The structured order of authority and responsibility within a family, often based on age, gender, or social roles.

Coercive Power

The ability to control others through the fear of punishment or threat, often used in organizational or leadership contexts.

Social Intelligence

is the capacity to understand and navigate social situations effectively, including reading others' emotions and adapting responses accordingly.

Q4: An unclassified balance sheet broadly groups accounts

Q8: The four common forms of business ownership

Q17: On September 12,Vander Company sold merchandise

Q20: For each of the accounts in the

Q102: A classified balance sheet organizes assets and

Q143: Paul's Landscaping paid $500 on account for

Q167: While in the process of posting from

Q176: Unearned revenue is classified as a(an)_ on

Q187: The balances for the accounts of Milo's

Q231: Booth Industries has liabilities of $105 million