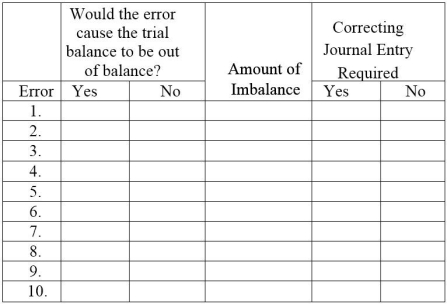

At year-end,Henry Laundry Service noted the following errors in its trial balance:

1.It understated the total debits to the Cash account by $500 when computing the account balance.

2.A credit sale for $311 was recorded as a credit to the revenue account,but the offsetting debit was not posted.

3.A cash payment to a creditor for $2,600 was never recorded.

4.The $680 balance of the Prepaid Insurance account was listed in the credit column of the trial balance.

5.A $24,900 van purchase was recorded as a $24,090 debit to Equipment and a $24,090 credit to Notes Payable.

6.A purchase of office supplies for $150 was recorded as a debit to Office Equipment.The offsetting credit entry was correct.

7.An additional investment of $4,000 by the stockholder was recorded as a debit to Common Stock and as a credit to Cash.

8.The cash payment of the $510 utility bill for December was recorded (but not paid)twice.

9.The revenue account balance of $79,817 was listed on the trial balance as $97,817.

10.A $1,000 cash dividend was recorded as a $100 debit to Dividends and $100 credit to Cash.

Using the form below,indicate whether each error would cause the trial balance to be out of balance,the amount of any imbalance,and whether a correcting journal entry is required.

Definitions:

Decomposer

Organisms, such as bacteria and fungi, that break down dead organisms and waste materials, recycling nutrients in ecosystems.

Fungi

A kingdom of complex organisms that obtain nutrients by breaking down organic material, including molds, yeast, and mushrooms.

Secondary Consumer

An organism that primarily eats primary consumers, which are herbivores that eat producers like plants and algae, situating it in the middle level of the food chain.

Organic Compound

A compound consisting of a backbone made up of carbon atoms.

Q26: A company has an investment in 9%

Q43: List the steps in processing transactions.

Q80: The higher a company's debt ratio,the lower

Q85: Holman Company owns equipment with an original

Q86: Verity Siding Company,whose sole stockholder is S.Verity,began

Q155: Unearned revenues refer to a(n):<br>A)Asset that will

Q180: Transactions are recorded first in the ledger

Q205: A business paid $100 cash to Charles

Q280: Farmers' net income was $740,000 and its

Q336: Adjusting entries made at the end of