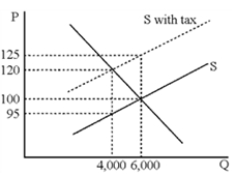

Figure 18-2

-Figure 18-2 shows the widget market before and after an excise tax is imposed.What percentage of the tax per widget is borne by consumers, considering the true economic incidence of the tax?

Definitions:

Work in Process Inventory

Goods that are in various stages of the production process but are not yet finished products.

Job-Order Costing

An accounting methodology used for tracking the production costs (materials, labor, and overhead) of custom products or jobs, allowing for detailed monitoring and costing of individual orders.

Ending Balance

The final amount in an account at the end of an accounting period after all debits and credits are accounted for.

Overapplied Overhead

This occurs when the overhead costs allocated to products or jobs exceed the actual overhead costs incurred.

Q44: Market economies have air and water pollution,

Q103: Voluntarism includes methods for dealing with pollution

Q134: In the area of taxation, the trade-off

Q143: According to the graph in Figure 18-1,

Q156: What are tax loopholes and what are

Q158: If the price of a depleting resource

Q167: Direct controls have a clear advantage when

Q170: The excess burden of an excise tax

Q171: A commodity is _ if it is

Q215: Demand for labor is<br>A)derived demand.<br>B)highly elastic.<br>C)dependant on