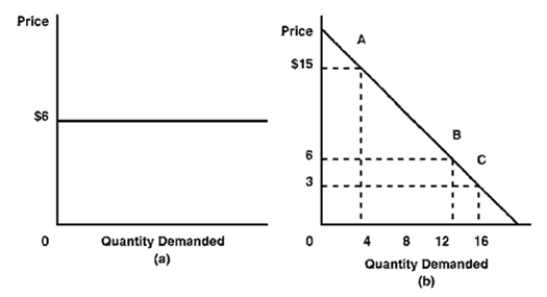

Figure 6-3

-Along the inelastic portion of a demand curve, the

Definitions:

FICA Social Security Taxes

Taxes paid by both employers and employees to fund the Social Security program, determined as a percentage of payroll.

FICA Medicare Taxes

These are taxes collected from both employers and employees in the United States to fund the Medicare program, which provides healthcare benefits for qualified individuals.

Federal Unemployment Taxes

Taxes imposed by the federal government on employers to fund state workforce agencies and unemployment insurance for workers who have lost their jobs.

State Unemployment Taxes

Taxes paid by employers to provide funding for unemployment compensation benefits for workers who have lost their jobs.

Q12: Complete the table below by computing the

Q28: Possible causes of an upward-sloping demand curve

Q33: The behavior of historical cost curves says

Q41: A well-known women's college whose tuition lagged

Q44: Firms can make decisions using marginal analysis

Q64: Lana spent $5 to see a movie.We

Q159: How will an increase in price tend

Q171: A firm is generally more interested in

Q188: A demand schedule shows the time over

Q198: Elasticity of demand equals the ratio of