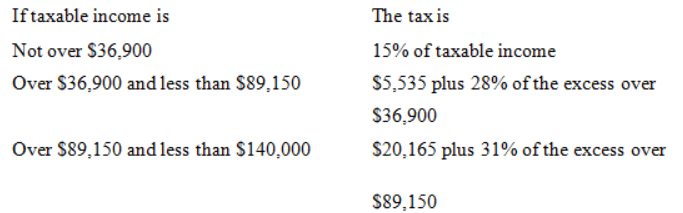

USE THE FOLLOWING TAX SCHEDULE TO ANSWER THE NEXT QUESTION.

-Amanda Huggins has an adjusted gross income of $45,500 and has itemized deductions and exemptions totaling $6,700. What is Ms. Huggins' marginal tax rate?

Definitions:

Benefits Promised

Guarantees or assurances given by an employer to employees, often relating to retirement, health care, or other support.

Case-by-Case Basis

A method of analysis or decision-making where each situation is considered individually, with attention to its unique aspects and details.

Substantial

Significantly valuable, large, or meaningful.

Repudiation

The rejection or refusal to acknowledge or pay a debt, obligation, or contract.

Q5: Which of the following is an accurate

Q6: Traditional line-item budgets:<br>A) focus attention on the

Q11: Indexation of individual income taxes is designed

Q13: Of the following types of satellite, which

Q13: The growth of Federal government spending in

Q16: One way automation can lead to the

Q17: Other things equal, a rise in income

Q17: Under some circumstances it is legal to

Q23: Which class of property has the highest

Q26: In 2011 a program named Watson running