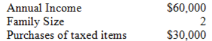

USE THE INFORMATION FOR THE NEXT QUESTION.

A state applies a 7 percent sales tax to consumer purchases of many items. These are data for a typical family:

-What average effective tax rate does the family pay?

Definitions:

Gross Profit Method

An accounting technique used to estimate the amount of ending inventory and cost of goods sold, based on the gross profit margin.

Ending Inventory

The total value of all unsold goods and materials that a company holds at the end of an accounting period.

Gross Profit on Sales

The difference between sales revenue and the cost of goods sold before deducting overheads, taxes, or interest.

FIFO Retail Inventory Method

An accounting method for valuing inventory where the first items purchased are the first ones to be sold.

Q2: The Unlicensed National Information Infrastructure (U-NII) band

Q3: Where was the first state-operated lottery of

Q7: <br>Other things equal, an increase in

Q9: The Supreme Court case Nordlinger v. Hahn

Q13: A gain of 6 dB means that

Q14: Explain, in the IS/LM/BP framework with fixed

Q18: Which of the following is not an

Q21: The present federal income tax structure would:<br>A)

Q26: In a Keynesian model, if MPM =

Q33: According to the Employee Polygraph Protection Act,