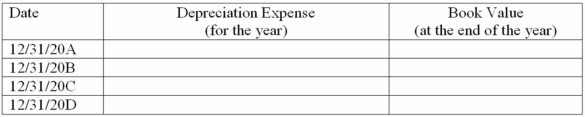

On January 1, 20A, Stern Company (a calendar year corporation) purchased a heavy duty machine having an invoice price of $13,000 plus transportation and installation costs of $3,000. The machine is estimated to have a 4-year useful life and a $1,000 residual value. Assuming the company uses the declining-balance method depreciation and a 150% acceleration rate, complete the following schedule (round to the nearest dollar).

Definitions:

Employment Discrimination

Unequal treatment of employees or job applicants on the basis of race, color, national origin, religion, gender, age, or disability; prohibited by federal statutes.

Interviews

Structured conversations where questions are asked to assess the qualifications, abilities, or opinions of the interviewees.

Union Election

A process by which members of a labor union vote to elect representatives or decide on other union-related matters.

Federal Labor Law

Legislation that regulates the rights and duties between employers and workers at the national level.

Q5: Which of the following is false?<br>A) Relevance

Q8: In industries in which price changes occur

Q28: Investing activities include<br>A) repaying money previously borrowed.<br>B)

Q33: The dollar amount of current assets is:<br>A)

Q35: The conceptual framework of accounting begins with<br>A)

Q48: Stretching a product line upward runs the

Q52: The stage of the product adoption process

Q98: Yell Company made a lump sum purchase

Q132: The application of marketing to influence people's

Q162: While sales discounts and credit card discounts