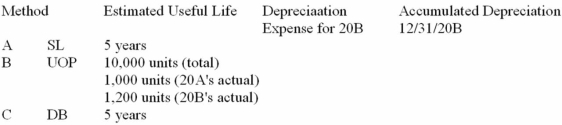

Duval Company acquired a machine on January 1, 20A, that cost $2,700 and had an estimated residual value of $200. Complete the following schedule using the three methods of depreciation: A. straight-line, B.) units-of-production, C.) declining-balance at 150% acceleration rate.

Definitions:

Dementia

A group of conditions characterized by impairment of at least two brain functions, such as memory loss and judgment.

Hearing Loss

A partial or total inability to hear sounds in one or both ears, which can be temporary or permanent, and vary in severity.

Ageism

Discrimination or prejudice against individuals based on their age, often directed towards older adults.

Medical Care

Professional services provided by healthcare practitioners to maintain, restore, or improve a person’s health.

Q35: Accelerated depreciation methods are not desirable from

Q49: On a multiple-step income statement, what happens

Q50: The characteristics of convenience, shopping, speciality, and

Q74: AA Riser owns machinery for moving and

Q89: For most merchandisers and manufacturers, the required

Q89: Which of the following functions does a

Q125: During 20A, Thomas Company recorded bad debt

Q126: In periods of falling prices, FIFO will

Q150: A company recorded net purchases of $20.3

Q156: All documents should be pre-numbered.