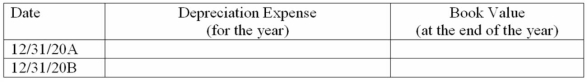

Sutter Company purchased a machine on January 1, 20A, for $16,000. The machine has an estimated useful life of 5 years and a $1,000 residual value. It is now December 31, 20B, and Sutter is in the process of preparing financial statements. Complete the following schedule assuming declining-balance method of depreciation with a 150% acceleration rate.

Definitions:

Severe Depression

A mental health condition characterized by deep sadness, loss of interest in activities, and other symptoms that impair daily functioning.

Canadian Psychiatric Association

A professional association in Canada that represents psychiatrists and advocates for the provision of high-quality mental health services.

First-Line Treatment

The initial, preferred method of treatment for a disease or condition, typically based on clinical evidence for its effectiveness.

SAD

Seasonal Affective Disorder, a type of depression that occurs at a specific time of year, usually during winter when there is less natural sunlight.

Q12: Restless Company's 20B income statement reported total

Q12: When a marketer plans to take an

Q14: The financial statements for Ozzie Company show

Q16: When a company uses the periodic inventory

Q41: Products which are consumed in a single

Q79: Martinelli Company recently purchased a truck. The

Q87: Concept testing requires the creation of a

Q92: Amounts invested in the shares and bonds

Q121: The product life cycle concept cannot be

Q127: Briefly describe market- penetration pricing. What benefits