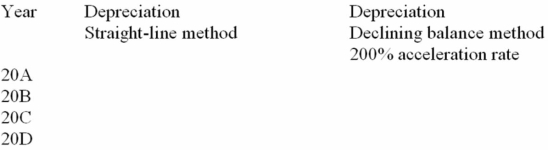

Hilman Company purchased a truck on January 1, 20A, at a cost of $34,000. The company estimated

that the truck would have a useful life of 4 years and a residual value of $4,000. Required:

1. Complete the following table:

2. Which of the two methods in part 1 would result in:

2. Which of the two methods in part 1 would result in:

a. Lower profit in 20A?

b. Lower profit in 20D? ________

Definitions:

Uniform Franchise Termination Act

A legal statute that standardizes the process and conditions under which a franchise relationship can be terminated.

Limited Partnership

A business structure where at least one partner is liable only to the extent of the amount of money they have invested.

Limited Partners

Investors in a partnership who have limited liability to the extent of their investment and typically do not partake in the day-to-day management of the business.

General Partners

are owners of a partnership who bear unlimited liability for the debts and obligations of the business.

Q6: On January 1, 20A, Virginia Company had

Q17: The Kappa Corporation is preparing to roll

Q24: Select the word that BEST completes the

Q49: In order to determine cost of goods

Q55: Sales revenue is measured as the market

Q59: Under the allowance method for uncollectible accounts,

Q66: Select the phrase that BEST completes the

Q87: If C Co.'s trade receivables balance was

Q140: Macon Assembly Company purchased a machine on

Q146: A company purchased goods on credit with