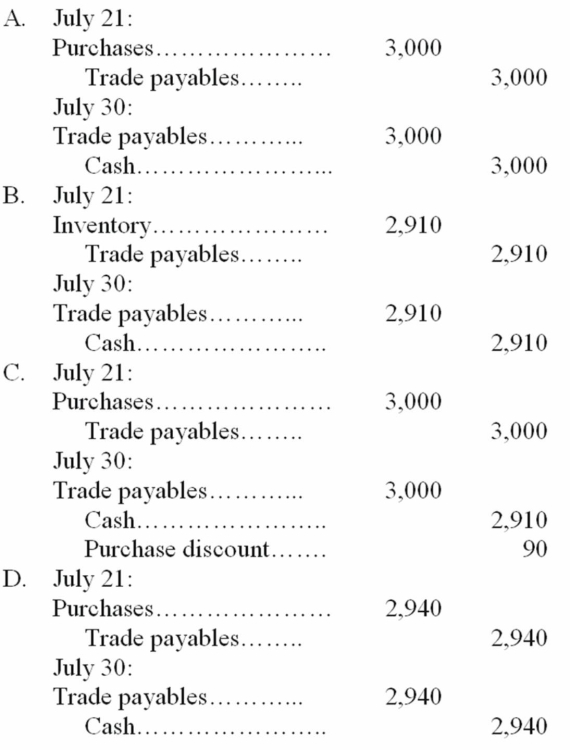

David Company uses the gross method to record its credit purchases, and it uses the periodic inventory system. On July 21, 20D, the company purchased goods that had an invoice price of $3,000 with terms of 3/10, n/30. If payment in full is made on July 30, the journal entries to record the purchase and payment should be which of the following?

Definitions:

Genotype

The genetic constitution of an organism, determining specific characteristics by encoding instructions for proteins.

AaMm

Represents a genotype consisting of two different alleles, Aa, for one trait and two different alleles, Mm, for another trait, indicating a hybrid individual.

Dominant Allele

An allele that expresses its phenotype even in the presence of a different (recessive) allele at the same genetic locus in a heterozygote.

Aniridia

A congenital condition characterized by the complete or partial absence of the iris, affecting the individual's vision.

Q5: Which of the following is false?<br>A) Relevance

Q14: Morrison Corporation, which uses a perpetual inventory

Q15: Give the journal entries for the transactions

Q20: Amortization expense is a result of the

Q23: A student friend has just finished what

Q62: On January 1, 20A, Reagan Company purchased

Q73: Which of the following is true?<br>A) Factory

Q106: If transportation costs are the responsibility of

Q125: A downward stretch of the product line

Q158: When do most companies usually recognize revenue