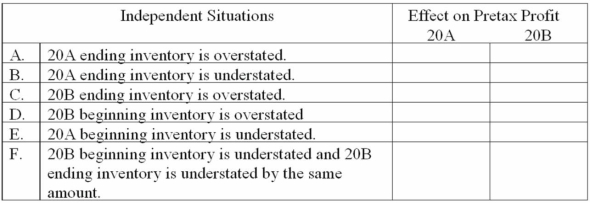

For each independent situation given below, determine the effect on pretax profit for each. Enter "+" to indicate pretax profit is overstated, "-" to indicate pretax profit is understated, or "NA" to indicate that pretax profit is not affected.

Definitions:

AASB 10

An Australian Accounting Standards Board standard that sets out the principles for the presentation and preparation of consolidated financial statements when an entity controls one or more other entities.

Consolidated Financial Statements

Financial statements that combine the financial information of a parent company and its subsidiaries into one document.

Non-controlling Interest

A minority ownership in a subsidiary that is not large enough to exert control over the company, reflected within the equity section of the consolidated financial statements.

Consolidated Equity

The total amount of owners' equity represented in a consolidated financial statement, which reflects the combine equity of a parent company and its subsidiaries.

Q12: Which of the following would most likely

Q30: Jane and Henry produce artworks for use

Q61: National brands and manufacturers' brands are essentially

Q66: To aid internal control, the individual authorized

Q67: Net realizable value is determined by adding

Q67: When the statement of cash flows is

Q77: The two fundamental qualitative characteristics are relevance

Q88: Upaway Company hired some students to help

Q131: The conceptual framework of accounting helps to

Q137: When an asset is retired, the amount