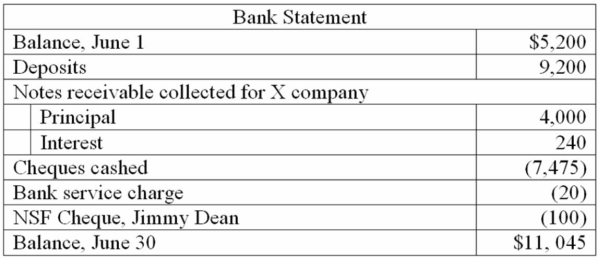

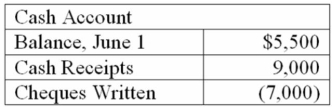

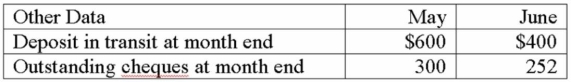

Finn Company has just received its June 30 bank statement from City Bank. The bank statement and the cash account, summarized below, are to be reconciled for the month of June.

Balance, June 1 $6,800

Balance, June 1 $6,800

Required:

Required:

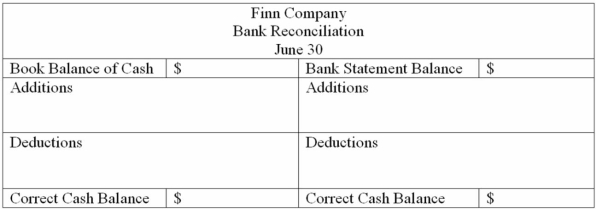

a. Prepare a bank reconciliation using the following format:

b. Give the journal entries that should be made in the accounts of Finn Company as a result of the above bank reconciliation.

b. Give the journal entries that should be made in the accounts of Finn Company as a result of the above bank reconciliation.

Definitions:

Jointly Controlled Entities

A corporate structure where two or more parties have control and share responsibility, rights, and liabilities for the entity's activities.

Line-by-Line Method

The line-by-line method is an accounting technique used in consolidating the financial statements of a parent company and its subsidiaries, where each line item of the subsidiary’s financial statements is added to the parent’s corresponding items.

AASB 11

Australian Accounting Standards Board pronouncement governing the accounting for arrangements between parties that are collectively controlling an economic activity.

Jointly Controlled Entities

Businesses owned and operated by two or more parties who share control and decisions, typically structured through contractual arrangements.

Q7: Each adjusting entry affects at least one

Q23: A company reports its 20B cost of

Q26: Under the periodic inventory system, the balance

Q38: Deposits in transit that appear on a

Q41: Ownership of goods passes from the seller

Q49: An increase in an asset is recorded

Q70: Deposits in transit to the bank have

Q102: The inventory turnover ratio measures the efficiency

Q121: A loss on disposal results if the

Q156: All documents should be pre-numbered.