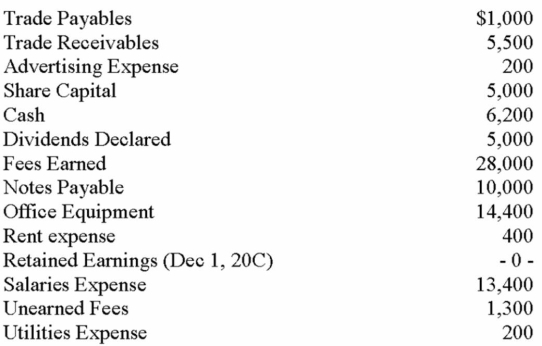

The following alphabetical listing shows all of the account balances taken from the unadjusted trial balance at December 31, 20C, the end of the first month in business for Virginia Graphics Corporation:

Virginia Graphics Corporation Unadjusted Trial Balance December 31, 20C  The note payable above was for $10,000 borrowed on December 1, 20C at the start of the business. The note and interest at 12% are to be repaid on June 30, 19E. The office equipment was acquired on December 1, 20C. It has an estimated life of 4 years with no salvage value. The company uses straight-line depreciation. The Unearned Fees resulted from $1,300 collected in advance from a new customer, Richmond Company, on December 10, 20C. By December 31, 20C, services amounting to

The note payable above was for $10,000 borrowed on December 1, 20C at the start of the business. The note and interest at 12% are to be repaid on June 30, 19E. The office equipment was acquired on December 1, 20C. It has an estimated life of 4 years with no salvage value. The company uses straight-line depreciation. The Unearned Fees resulted from $1,300 collected in advance from a new customer, Richmond Company, on December 10, 20C. By December 31, 20C, services amounting to

$1,000 had been provided to Richmond Company. The company expects to pay income taxes of 10% on pretax profit.

Virginia Graphics needs help in preparing its financial statements for its first month in business. Sinc you are taking an accounting course, your neighbour, the owner of Virginia Graphics, has asked you to help.

Required:

1. Prepare the necessary adjusting journal entries based on the information provided above. (You nee not include explanations).

2. Prepare an income statement.

3. Explain the effect on the income statement if the adjustment for interest expense had not been made.

Definitions:

Xiphoid Process

The smallest and lowermost part of the sternum, providing attachment points for muscles and ligaments of the abdomen.

Sternal Angle

The sternal angle, or Angle of Louis, is the anatomical landmark formed by the joint between the manubrium and the body of the sternum, often used as a reference point for rib identification.

Intervertebral Foramen

The opening between adjacent vertebrae through which spinal nerves exit the spinal column.

Vertebral Canal

The hollow area within the vertebral column that houses and protects the spinal cord.

Q9: The method of inventory cost determination that

Q28: The WD Co. reported revenue of $23,402

Q40: On January 1, 2014, Calas Company acquired

Q63: Which of the following businesses would not

Q64: The primary objective of statement of cash

Q82: At the end of 20C, Libby Company

Q102: Which of the following items has no

Q113: Maxell Company uses the periodic FIFO method

Q138: An error that overstates the ending inventory

Q140: You have recently started a part time