Four transactions are given below that were completed during 20A by Lucky Company. The annual accounting period ends December 31. Each transaction will require an adjusting entry at December 31, 20A. Provide the adjusting entry required.

A. On January 1, 20A, Lucky Company purchased office equipment that cost $8,000. The estimated life of the office equipment was five years ($500 residual value).

December 31, 20A--Adjusting entry:

B. On June 1, 20A, Lucky Company paid $12,600 for one year's rent beginning on that date. The rent

payment was recorded as follows:

June 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

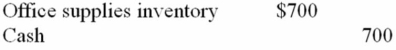

C. Lucky Company purchased office supplies during the year that cost $700 and placed the supplies in a storeroom for use as needed. The purchase was recorded as follows:

February 1, 20A:

At the end of 20A, a count showed unused office supplies of $200 in the storeroom. There was no beginning inventory of supplies on hand.

At the end of 20A, a count showed unused office supplies of $200 in the storeroom. There was no beginning inventory of supplies on hand.

December 31, 20A--Adjusting entry:

D. On December 31, 20A, Lucky Company owed employees $3,000 for wages earned during December. These wages had not been paid nor recorded.

December 31, 20A--Adjusting entry:

Definitions:

Dangling Modifier

A word or phrase that modifies a word not clearly stated in the sentence, leading to confusion or misinterpretation.

Lack of Parallelism

A stylistic or grammatical flaw where elements in a sentence or list do not maintain a consistent structure or pattern.

Hedging

The use of cautious language to make statements less absolute, often for the purpose of reducing risk or uncertainty.

Readability

The ease with which text can be read and understood by the target audience, often influenced by factors such as language, structure, and design.

Q7: The books of Tweed Company provided the

Q35: The conceptual framework of accounting begins with<br>A)

Q48: The continuity assumption is inappropriate when<br>A) liquidation

Q51: Virginia Equipment, Inc., sold and issued 4,000

Q55: If a revenue account is credited, the

Q75: Winn Company's 20B income statement reported total

Q100: Unadjusted financial statements do not reflect revenues

Q113: Which of the following websites provides access

Q126: A liability is normally classified as a

Q127: If the terms are 3/15, n/45 on