Below are four transactions that were completed during 20A by Doby Company. The annual accounting period ends on December 31. Each transaction will require an adjusting entry at Decembe 31, 20A. You are to provide the 20A adjusting entries required for Doby Company.

A. On July 1, 20A, Doby Company paid a two-year insurance premium for a policy on its equipment This transaction was recorded as follows:

July 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

B. On December 31, 20A a tenant renting some office space from Doby Company had not paid the rent of $500 for December.

December 31, 20A--Adjusting entry:

C. On September 1, 20A, Doby Company borrowed $3,000 cash and gave a one-year, 10 percent, note payable. The total interest of $300 is payable on the due date, August 31, 20B. The note was recorded as follows:

September 1, 20A: Cash $3,000

Note payable $3,000

December 31, 20A--Adjusting entry:

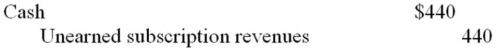

D. Assume Doby Company publishes a magazine. On October 1, 20A, the company collected $440 for subscriptions two years in advance. The $440 collection was recorded as follows:

October 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

Definitions:

Clearing

The process of reconciling purchases and sales of various securities, commodities, or currencies and ensuring the correct transfer of funds.

Collection Float

The time period between when a check is deposited into a bank account and the funds become available.

Ledger Balance

represents the total balance in a general ledger account at the beginning of each day, including all transactions that have been posted.

Available Balance

The amount of funds in an account that is accessible for withdrawal or use, taking into account any holds or pending transactions.

Q30: Accounting information should be neutral in order

Q38: Which of the following liability accounts is

Q40: On January 1, 2014, Calas Company acquired

Q40: Which of the following would most likely

Q48: Hayes Company had an average age of

Q50: The statement of earnings reports profit or

Q62: The purpose of preparing the post-closing trial

Q101: The sales revenue reported on the income

Q127: If a company has both an inflow

Q149: When using the allowance method for bad