Four transactions are given below that were completed during 20A by Wren Company. The annual accounting period ends December 31. Each transaction requires an adjusting entry at December 31, 20A. You are to provide the adjusting entries required for Wren Company.

A. On December 31, 20A, Wren Company owed employees $1,750 for wages that were earned by them during December and were not recorded.

December 31, 20A--Adjusting entry:

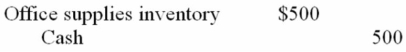

B. During 20A, Wren Company purchased office supplies that cost $500 which were placed in the supplies room for use as needed. The purchase was recorded as follows:

20A:

At the beginning of 20A, the inventory of unused office supplies was $75. At the end of 20A, a coun showed unused office supplies in the supply room amounting to $100.

At the beginning of 20A, the inventory of unused office supplies was $75. At the end of 20A, a coun showed unused office supplies in the supply room amounting to $100.

December 31, 20A--Adjusting entry:

C. On December 1, 20A, Wren Company rented some office space to another party. Wren collected

$900 rent for the period December 1, 20A, to March 1, 20B. The rent collected was recorded as

follows:

December 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

D. On June 1, 20A, Wren Company borrowed $2,000 cash on a one-year, 10% interest-bearing, note payable. The interest is payable on the due date, May 31, 20B. The note was recorded as follows:

June 1, 20A:

Definitions:

Portfolio

A collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including mutual funds and ETFs.

Successive Years

Successive years that occur back-to-back without any breaks.

Compounded Quarterly

A method of calculating interest where it is added to the principal four times a year, after every three months, leading to faster growth of the investment.

Prepayment

Payment made for goods or services before they are received or required.

Q8: Which of the following accounts is only

Q20: A high inventory turnover ratio indicates a

Q27: Liabilities are generally classified on a statement

Q28: The following data were reported for Marcellan

Q28: The three sections of the statement of

Q34: A T account is<br>A) a way of

Q54: All of the following ratios are investor

Q66: Expenses incurred, but not yet paid, create

Q88: The relationship between current assets and current

Q159: An example of separation of duties is