Below are four transactions that were completed during 20A by Doby Company. The annual accounting period ends on December 31. Each transaction will require an adjusting entry at Decembe 31, 20A. You are to provide the 20A adjusting entries required for Doby Company.

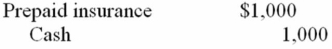

A. On July 1, 20A, Doby Company paid a two-year insurance premium for a policy on its equipment This transaction was recorded as follows:

July 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

B. On December 31, 20A a tenant renting some office space from Doby Company had not paid the rent of $500 for December.

December 31, 20A--Adjusting entry:

C. On September 1, 20A, Doby Company borrowed $3,000 cash and gave a one-year, 10 percent, note payable. The total interest of $300 is payable on the due date, August 31, 20B. The note was recorded as follows:

September 1, 20A: Cash $3,000

Note payable $3,000

December 31, 20A--Adjusting entry:

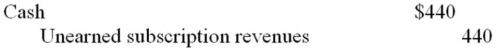

D. Assume Doby Company publishes a magazine. On October 1, 20A, the company collected $440 for subscriptions two years in advance. The $440 collection was recorded as follows:

October 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

Definitions:

Convenience Sampling

A sampling method where participants are selected based on their availability and willingness to take part, rather than using random selection.

Dependent Variable

In an experiment, the condition that may or may not change as a result of changes in the independent variable.

Vitamin Supplement

A dietary addition that provides nutrients, such as vitamins or minerals, intended to supplement one's nutrition.

IQ Test

A standardized test designed to measure human intelligence and cognitive abilities in relation to an average score for one's age group.

Q16: The revenue recognition principle indicates that revenue

Q30: Accrued in the case of expenses means

Q38: On the multiple step income statement, which

Q47: The payment to shareholders for repurchase of

Q52: Indicate the proper category for each ratio.<br>Primary

Q62: Idaho Company purchased 30% of the outstanding

Q70: A liquidity ratio measures the<br>A) number of

Q93: You have been hired as the accountant

Q100: Why is the historical cost principle so

Q110: On September 1, 20A, RF Corporation collected