Four transactions are given below that were completed during 20A by Wren Company. The annual accounting period ends December 31. Each transaction requires an adjusting entry at December 31, 20A. You are to provide the adjusting entries required for Wren Company.

A. On December 31, 20A, Wren Company owed employees $1,750 for wages that were earned by them during December and were not recorded.

December 31, 20A--Adjusting entry:

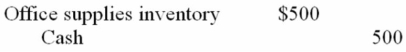

B. During 20A, Wren Company purchased office supplies that cost $500 which were placed in the supplies room for use as needed. The purchase was recorded as follows:

20A:

At the beginning of 20A, the inventory of unused office supplies was $75. At the end of 20A, a coun showed unused office supplies in the supply room amounting to $100.

At the beginning of 20A, the inventory of unused office supplies was $75. At the end of 20A, a coun showed unused office supplies in the supply room amounting to $100.

December 31, 20A--Adjusting entry:

C. On December 1, 20A, Wren Company rented some office space to another party. Wren collected

$900 rent for the period December 1, 20A, to March 1, 20B. The rent collected was recorded as

follows:

December 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

D. On June 1, 20A, Wren Company borrowed $2,000 cash on a one-year, 10% interest-bearing, note payable. The interest is payable on the due date, May 31, 20B. The note was recorded as follows:

June 1, 20A:

Definitions:

Cash Cycle

The cash cycle measures the time it takes for a company to convert its inventory and other resources into cash flows from sales, indicating the efficiency of a company's cash management.

First Quarter

Typically refers to the first three months of a financial year, used as a reporting period by businesses and other organizations.

Operating Cycle

The duration between a company's purchase of inventory and the receipt of cash from accounts receivable, reflecting the efficiency of a company's cash flow.

Inventory

refers to the goods and materials a business holds for the ultimate goal of resale or production.

Q19: The comparative balance sheets for Gillen Inc.

Q24: Oucher Corporation's bank statement included two types

Q29: Financial analysts, using modern information technology to

Q38: When a business pays a previously recorded

Q42: Which of the following accounts is always

Q58: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4662/.jpg" alt=" The following changes

Q67: Which one of the following ratios would

Q70: In the indirect method, a gain on

Q89: Rye Company purchased 15% of Lena Company's

Q93: If a company has a current ratio