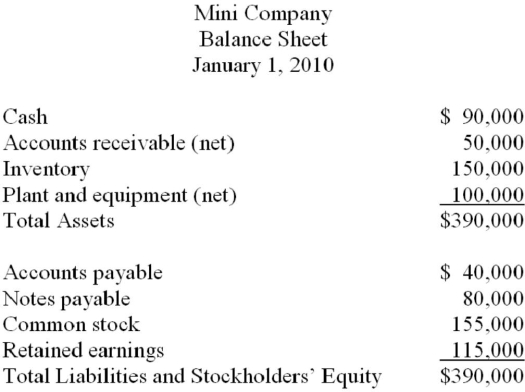

The balance sheet of Mini Company was as follows immediately before it was acquired b Maxi Company:  On January 1, 2010, Maxi Company paid $350,000 in cash for 100% of the outstanding common stock of Mini Company. The current market value of Mini Company's plant and equipment was $140,000 on the date of acquisition. If the market value and book value ar the same for Mini's remaining assets, what is the net increase in Maxi's assets as a result o the merger with Mini?

On January 1, 2010, Maxi Company paid $350,000 in cash for 100% of the outstanding common stock of Mini Company. The current market value of Mini Company's plant and equipment was $140,000 on the date of acquisition. If the market value and book value ar the same for Mini's remaining assets, what is the net increase in Maxi's assets as a result o the merger with Mini?

Definitions:

Q19: The following data were reported by Jupiter

Q21: Both the adjusting entries and the closing

Q23: Towson Inc. had 300,000 common shares before

Q51: The category that is generally considered to

Q75: Financing activities involve<br>A) issuing shares.<br>B) acquiring long-lived

Q78: The income statement is prepared by using

Q86: The sale of merchandise on credit and

Q89: Rye Company purchased 15% of Lena Company's

Q103: If you trade your computer plus cash

Q124: One part of an adjusting entry is