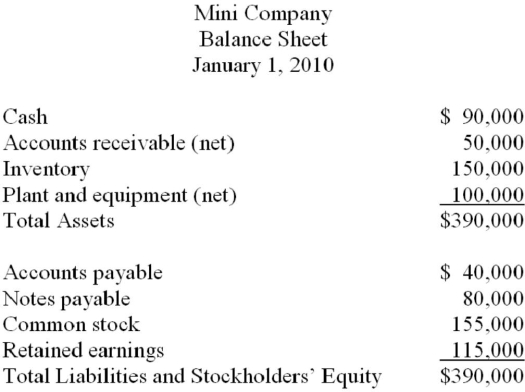

The balance sheet of Mini Company was as follows immediately before it was acquired b Maxi Company:  On January 1, 2010, Maxi Company paid $350,000 in cash for 100% of the outstanding common stock of Mini Company. The current market value of Mini Company's plant and equipment was $140,000 on the date of acquisition. If the market value and book value ar the same for Mini's remaining assets, what is the net increase in Maxi's assets as a result o the merger with Mini?

On January 1, 2010, Maxi Company paid $350,000 in cash for 100% of the outstanding common stock of Mini Company. The current market value of Mini Company's plant and equipment was $140,000 on the date of acquisition. If the market value and book value ar the same for Mini's remaining assets, what is the net increase in Maxi's assets as a result o the merger with Mini?

Definitions:

Risk-Free Asset

An investment with a guaranteed return and no risk of financial loss.

Standard Deviation

Standard deviation measures the amount of variation or dispersion from the average in a set of data points, indicating how spread out the numbers are.

Real Rate of Interest

The interest rate that has been adjusted to remove the effects of inflation; reflects the true cost of borrowing.

Nominal Rate

The rate of interest before adjustments for inflation, representing the face value rate agreed upon in financial instruments and agreements.

Q6: The statement of earnings provides investors with

Q21: Calculate C Co's current ratio for 2012

Q32: The sale of a stock from the

Q49: The statement of cash flows shows the

Q50: The statement of earnings reports profit or

Q56: The authorized shares of a corporation<br>A) only

Q92: Goodgold Corporation purchased a machine which had

Q92: The primary difference in accounting for available-for-sale

Q93: Which of the following is not considered

Q107: Which of the following businesses would most