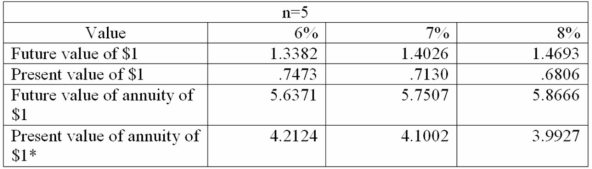

The following table values are provided for use in solving the following independent problems (show computations):

*Ordinary annuity

*Ordinary annuity

A. Company A deposited $20,000 in a savings account on January 1, 19A that will accumulate 6% interest each December 21.

1. What will be the fund balance at the end of Year 5

2. How much interest will be earned by the end of Year 5?

B. Company B needs to accumulate a $50,000 fund by making five equal annual deposits. Assuming a 7% interest accumulation, how much must be deposited at the end of the year?

C. Company C has new machine that has an estimated life of five years and a $5,000 residual value. Assuming an 8% interest rate, what is the present value of the estimated residual value?

D. Company D owes a $50,000 debt that is now due (January 1, 19A). Arrangements have been made to pay it off in five equal annual installments, starting December 31, 19A (an ordinary annuity situation).

1. Assuming 8% interest, how much will the annual payment be?

2. Give the entry for Company D above for the first payment on December 31, 19A on the note payable.

Definitions:

Alarm Clock

A device used to awaken individuals from sleep at a set time with an alarm.

Myopia

A condition where individuals or organizations focus on short-term gains at the expense of long-term benefits, often leading to suboptimal decisions.

Time Inconsistency

The phenomenon where a person's preferences change over time, such that what is preferred in the future is inconsistent with what is preferred now, often leading to planning and decision-making challenges.

Behavioral Economists

Researchers who study the psychological, cognitive, emotional, cultural, and social factors that affect the economic decisions of individuals and institutions.

Q10: What response would you expect in a

Q14: Freeman Inc. reported a profit of $40,000

Q17: You are evaluating a patient's understanding of

Q17: A patient prescribed vancomycin (Vancocin) has developed

Q27: Notes payable are sometimes used instead of

Q32: On September 1, Hauser Corp. borrowed $70,000

Q82: Complete the following statement of earnings (both

Q88: On December 31, 20A, Bennett recorded an

Q91: Discuss how the equity method prevents managers

Q129: Marie is considering several possible investment alternatives.<br>