Lopez Corporation began operations at the start of 20C. During the year, it made cash and credit sale totalling $974,000 and collected $860,000 in cash from its customers. It purchased inventory costing

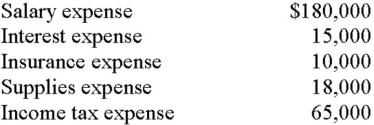

$508,000, paid $25,000 for dividends and the cost of goods sold was $445,000. The corporation incurred the following expenses:

Required:

Required:

1. Prepare an income statement showing revenues, expenses, pretax profit, income tax expense, and profit for the year ended December 31, 20C.

2. Based on the above information, what is the amount of trade receivables on the statement of financial position prepared at the end of 20C?

3. Based on the above information, what is the amount of retained earnings on the statement of financial position prepared at the end of 20C?

Definitions:

Case Manager

A healthcare professional responsible for coordinating appropriate healthcare services and resources for individuals, particularly those with complex or ongoing medical conditions.

Social Worker

A professional who provides support and resources to people dealing with personal and social challenges to improve their well-being.

Case Manager

A professional responsible for planning and coordinating care and services for individuals or families, usually within healthcare or social services.

Home Health Nurse

A registered nurse who provides medical assistance and care to patients in their homes, often for those recovering from illness or surgery.

Q3: Typical non-current liabilities include lease obligations, asset

Q5: All contingent liabilities should be classified as

Q11: What are "Future Income taxes"? Where specifically

Q12: Regan, Inc., declared a cash dividend of

Q19: What precaution should you take to prevent

Q20: Which neurotransmitter has an inhibitory action within

Q31: Dole Corporation is in the process of

Q79: What are the advantages of issuing common

Q125: Pleasant Company has established a pension plan

Q145: Match the way a bond will sell