Lopez Corporation began operations at the start of 20C. During the year, it made cash and credit sale totalling $974,000 and collected $860,000 in cash from its customers. It purchased inventory costing

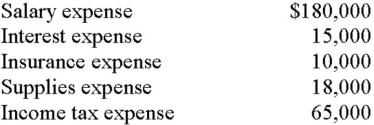

$508,000, paid $25,000 for dividends and the cost of goods sold was $445,000. The corporation incurred the following expenses:

Required:

Required:

1. Prepare an income statement showing revenues, expenses, pretax profit, income tax expense, and profit for the year ended December 31, 20C.

2. Based on the above information, what is the amount of trade receivables on the statement of financial position prepared at the end of 20C?

3. Based on the above information, what is the amount of retained earnings on the statement of financial position prepared at the end of 20C?

Definitions:

Perpetual Inventory System

An inventory accounting method where transactions are recorded on the spot with the help of computerized point-of-sale systems and enterprise asset management tools.

Trade Discount

A reduction in the listed price of goods or services offered by sellers to buyers as an incentive or for bulk purchases, not recorded separately in financial books.

Catalog List Price

The advertised price of a product or service in a catalog, before any discounts or promotions.

Cost of Inventory Sold

The total cost of goods sold during a specific period, including the cost of acquiring or manufacturing the goods.

Q3: What is the difference between the generic

Q5: Which condition is the most dangerous adverse

Q5: Which of the following patients is most

Q13: Match the type of bond with the

Q53: On January 1, 2013, Osler Limited, a

Q68: If you wanted to know what accounting

Q77: Retained earnings represents the amount of cash

Q91: Company P had pretax profit of $30,000

Q119: Accounting is based on man-made rules that

Q150: A long-term note payable is often secured