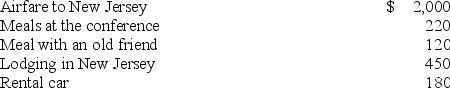

Shelley is self-employed in Texas and recently attended a two-day business conference in New Jersey. After Shelley attended the conference, she had dinner with an old friend who lived nearby. Shelly documented her expenditures (described below) . What amount can Shelley deduct?

Definitions:

Working Capital Investment

Funds used to finance day-to-day business operations, such as inventory purchase and accounts receivable.

Discount Rate

The interest rate used to discount future cash flows to their present values.

Net Present Value

The gap between the present worth of money coming in and going out over an established duration.

Pretax Return

The income or profit of a company before income tax expenses are deducted.

Q1: Which form of dance is essentially anti-balletic

Q13: The plane that divides the body into

Q17: Examine the director's role in cinema and

Q18: Anna received $15,000 from life insurance paid

Q21: Glenn is an accountant who races stock

Q25: The Parthenon is an example of what

Q57: Polysaccharides can be broken down into simple

Q71: Generally, which of the following does not

Q109: Pam recently was sickened by eating spoiled

Q120: This year, Barney and Betty sold their