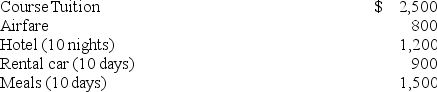

Sam operates a small chain of pizza outlets in Fort Collins, Colorado. In November of this year Sam decided to attend a two-day management training course. Sam could choose to attend the course in Denver or Los Angeles. Sam decided to attend the course in Los Angeles and take an eight-day vacation immediately after the course. Sam reported the following expenditures from the trip:

What amount of travel expenditures can Sam deduct?

What amount of travel expenditures can Sam deduct?

Definitions:

Q1: Long-term capital gains (depending on type)for individual

Q6: This year Kelly bought a new auto

Q13: Analyze the effects of linear, atmospheric, and

Q21: Which of the following is the term

Q22: Big Homes Corporation is an accrual-method calendar-year

Q37: Baker is single and earned $225,000 of

Q71: Adjusted taxable income is defined as follows

Q73: Apollo is single and his AMT base

Q87: Cyrus is a cash method taxpayer who

Q131: Which of the following statements best describes