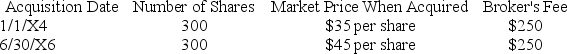

On December 1, 20X7, George Jimenez needed a little extra cash for the upcoming holiday season, and sold 250 shares of Microsoft stock for $50 per share less a broker's fee of $200 for the entire sale transaction. Prior to the sale, George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase). (Do not round intermediate calculations.)

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

Definitions:

Trimmed Mean

A method of averaging that involves removing a certain percentage of the largest and smallest values before calculating the mean.

Bootstrap Distribution

A statistical technique for estimating the sampling distribution of an estimator by resampling with replacement from the original dataset.

Observed Mean

The arithmetic average of observed values in a dataset, calculated as the sum of all observations divided by the number of observations.

P-value

A statistical measure that helps researchers determine the significance of their research results, indicating the probability of observing the collected data, or something more extreme, if the null hypothesis were true.

Q3: The Tanakas filed jointly in 2019. Their

Q17: Adjusted taxable income for calculating the business

Q18: _ can be either formal or informal.<br>A)Sonnets<br>B)Novels<br>C)Metaphors<br>D)Essays

Q19: Which of the following defines bodily movement

Q28: Which of the following is a true

Q30: In certain circumstances a child with very

Q78: Congress allows self-employed taxpayers to deduct the

Q83: All of the following represent a type

Q106: Jack paid $5,000 in daycare expenses for

Q109: Pam recently was sickened by eating spoiled