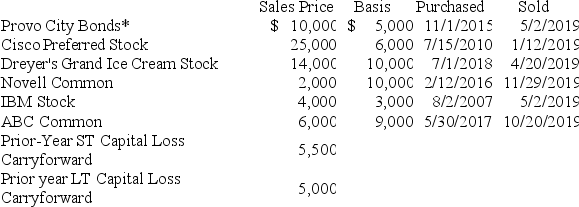

Scott Bean is a computer programmer and incurred the following transactions last year.

*Purchased when originally issued by Provo City.

*Purchased when originally issued by Provo City.

What is the net short-term capital gain/loss reported on the 2019 Schedule D? What is the net long-term capital gain/loss reported on the 2019 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

Definitions:

Contract

A legal commitment made between two or more participants that is upheld by law.

Breach

The violation of a law, duty, or other form of agreement.

Warranty

A guarantee provided by a manufacturer or seller regarding the condition of a product and the promise to repair or replace defective parts within a specified period.

Replevin

A legal action to recover personal property that has been wrongfully taken or retained.

Q6: With what work did Toni Morrison win

Q18: Taxpayers are generally allowed to carry back

Q45: Rachel is an accountant who practices as

Q48: Gambling winnings are included in gross income

Q71: Business credits are generally refundable credits.

Q73: Apollo is single and his AMT base

Q92: Looking at the following partial calendar for

Q94: If both spouses of a married couple

Q130: Ben received the following benefits from his

Q153: Tax credits reduce a taxpayer's taxable income