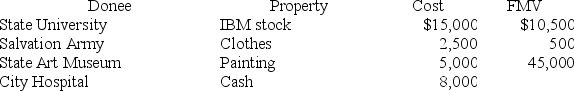

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum in a manner consistent with the museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum in a manner consistent with the museum's charitable purpose.

Definitions:

Parent-child Conflict

Refers to disagreements and confrontations between parents and children, often stemming from differences in opinions, desires, or values.

Transition to Adolescence

The period in a person's life where they move from childhood through puberty to reach physical and psychological maturity.

First-born

describes the eldest child in a family, who may experience unique social and psychological dynamics compared to their siblings.

Sperm Count

The concentration of sperm cells in a specified amount of male ejaculate, which is a key indicator of male fertility.

Q7: Investment expenses (other than investment interest expenses)are

Q7: Quantitatively, what is the relationship between the

Q18: Capital loss carryovers for individuals are carried

Q41: Ralph borrowed $4 million and used the

Q49: A taxpayer's at-risk amount in an activity

Q57: Which of the following courts is the

Q62: A taxpayer earning income in "cash" and

Q63: When applying credits against a taxpayer's gross

Q76: According to Statements on Standards for Tax

Q91: Individual proprietors report their business income and