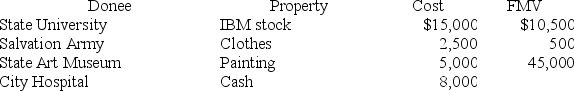

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum in a manner consistent with the museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum in a manner consistent with the museum's charitable purpose.

Definitions:

Androgens

A group of hormones that play a role in male traits and reproductive activity; present in both males and females.

Ovaries

The female reproductive organs responsible for producing eggs (ova) and sex hormones, such as estrogen and progesterone.

Pituitary Gland

is a small, pea-sized gland located at the base of the brain, often termed the "master gland" because it controls the activities of other endocrine glands, influencing growth, metabolism, and reproductive functions.

Mammary Glands

Specialized organs in mammals that produce milk to feed young offspring.

Q8: Generally, losses from rental activities are considered

Q20: Which of the following has the lowest

Q23: The constructive receipt doctrine:<br>A)is particularly restrictive for

Q25: Bill filed his 2019 tax return on

Q37: Dan received a letter from the IRS

Q67: The taxable income levels in the married

Q89: Hannah, who is single, received a qualified

Q93: Katlyn reported $300 of net income from

Q105: Paying dividends to shareholders is one effective

Q110: Jason's employer pays year-end bonuses each year