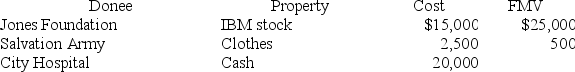

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting have been owned for 10 years.

Definitions:

Loanable Funds

The total amount of capital available for borrowing, comprised of savings from individuals, businesses, and government, which is available for investment purposes.

Commercial Paper

A short-term, unsecured promissory note issued by corporations, often used for the financing of accounts receivable, inventories, and meeting short-term liabilities.

Treasury Bill

Short-term government securities issued with a maturity of one year or less, used to finance the government's debt.

High-Quality Corporate Borrower

A corporation with a strong credit rating, indicating a low risk of default to lenders.

Q25: An individual receiving $5,000 of tax-exempt income

Q30: Lebron received $50,000 of compensation from his

Q54: Which of the following does not limit

Q61: Which of the following is an explanation

Q64: Which of the following expenditures is completely

Q68: Jim received a $500 refund of state

Q71: Antonella works for a company that pays

Q82: If Julius has a 22 percent tax

Q99: Wendell is an executive with CFO Tires.

Q99: The goal of tax planning generally is