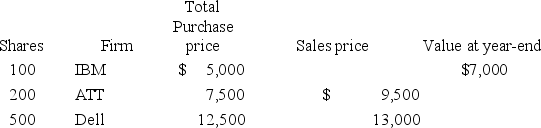

This year Ann has the following stock transactions. What amount is included in her gross income if Ann paid a $200 selling commission for each sale?

Definitions:

Avoided

In legal or contractual contexts, refers to actions or circumstances that render an agreement invalid or not enforceable.

Resold

The act of selling an item that has previously been sold, often referring to goods bought for the purpose of resale.

Resale Price

The resale price is the amount for which goods or services are sold again to consumers or businesses after being bought from the original seller or producer.

Incidental Damages

Incidental damages refer to secondary or peripheral expenses that result from a breach of contract, such as the costs incurred to mitigate losses or to cover additional operational expenses.

Q14: Jane and Ed Rochester are married with

Q29: Maria and Tony are married. They are

Q44: Sally is a cash-basis taxpayer and a

Q46: The constructive receipt doctrine is a natural

Q71: Jennifer owns a home that she rents

Q78: John is a self-employed computer consultant who

Q79: Ethan (single)purchased his home on July 1,

Q83: Joe Harry, a cash-basis taxpayer, owes $20,000

Q92: Heidi (single)purchased a home on January 1,

Q94: Bunching itemized deductions is one form of