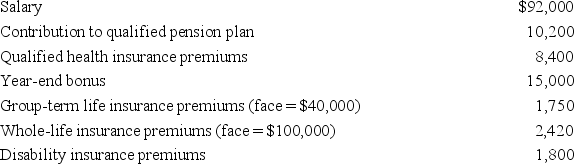

Andres has received the following benefits this year.

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Definitions:

Negative Transfer

A learning phenomenon where learning in one context or task hinders performance in another due to similarities that confuse the learner.

Decay

The process by which information is lost over time from memory, especially when it is not rehearsed or reviewed.

Consolidation

A process in neuroscience, particularly regarding memory, where short-term memories are transformed into more stable, long-term memories.

New Learning

The process of acquiring new knowledge or skills.

Q3: Taxpayers never pay tax on the earnings

Q9: Henry and Janice are married and file

Q25: To provide relief from double taxation, Congress

Q34: Assuming an after-tax rate of return of

Q34: Which of the following statements regarding the

Q56: Retired taxpayers over 59½ years of age

Q60: All investment expenses are itemized deductions.

Q102: Tax rate schedules are provided for use

Q117: Charles, who is single, pays all of

Q123: Candace is claimed as a dependent on