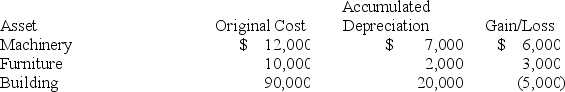

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

ANS

Part of the involuntary nervous system that controls the heart, stomach, and intestines.

Intrinsically Rewarding

An activity or action that is rewarding in itself, providing a sense of satisfaction and fulfillment without the need for external rewards.

Engaged

Being actively involved or committed to a particular activity, cause, or task.

Flow

The psychological state of being completely immersed and fully engaged in an activity, often leading to optimal performance and enjoyment.

Q2: Which of the following statements regarding compensation

Q9: Which of the following statements regarding Roth

Q23: Odintz traded land for land. Odintz originally

Q25: Maren received 10 NQOs (each option gives

Q29: The effective tax rate expresses the taxpayer's

Q31: Accounts receivable and inventory are examples of

Q36: Which of the following taxes represents the

Q49: Jaime recently found a "favorable" trial-level court

Q69: Victor has no desire to supervise other

Q81: Which of the following best describes a