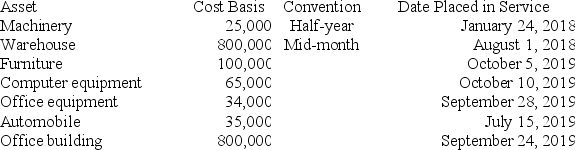

Boxer LLC has acquired various types of assets recently used 100 percent in its trade or business. Below is a list of assets acquired during 2018 and 2019:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2018, but would like to take advantage of the §179 expense and bonus depreciation for 2019 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2019. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10. )(Round final answer to the nearest whole number.)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2018, but would like to take advantage of the §179 expense and bonus depreciation for 2019 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation deduction for 2019. (Use MACRS Table 1, MACRS Table 5, and Exhibit 10-10. )(Round final answer to the nearest whole number.)

Definitions:

Counteradvertising Order

A directive, often issued by a court or regulatory agency, requiring a business to advertise against its own previous misleading advertisements to correct public misinformation.

Substantiated

Supported with evidence or proof; verified as being true, accurate, or justified.

Equal Credit Opportunity Act

A U.S. federal law that prohibits discrimination by lenders against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age, or because they receive public assistance.

Credit Decisions

The process by which lenders determine the creditworthiness of potential borrowers and decide whether to extend credit.

Q11: When an employer matches an employee's contribution

Q12: Elizabeth saw a posting for a new

Q15: Winchester LLC sold the following business assets

Q20: When meeting an interviewer, which of the

Q23: Don owns a condominium near Orlando, California.

Q41: Felix just renegotiated a contract with his

Q53: When employees contribute to a Roth 401(k)account,

Q89: Emi has worked as a computer programmer

Q95: Alexandra purchased a $55,000 automobile during 2019.

Q109: Jackson has the choice to invest in