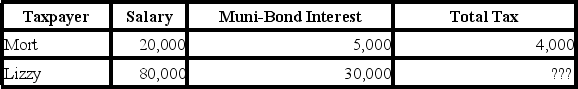

Given the following tax structure, what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to effective tax rates?

Definitions:

Fallacy

A misleading or deceptive argument that appears logical but fails to hold up to scrutiny.

Truth

The property of statements that accurately reflect reality or are in accordance with facts.

Subjectivist Fallacies

Errors in reasoning that occur when subjective opinions or personal preferences are presented as objective facts.

Fallacy

A fallacy is a misleading or unsound argument that appears logical at first glance but does not hold up under scrutiny, often due to flawed reasoning or misleading premises.

Q1: Northern LLC only purchased one asset this

Q8: What concerns do women face in today's

Q9: Which of the following is NOT one

Q10: An exit strategy is often included in

Q15: Sandra is an office manager. She believes

Q29: Which type of plan will keep an

Q48: Bonus depreciation is used as a stimulus

Q67: The majority of companies are structured with

Q74: Tyson (48 years old)owns a traditional IRA

Q78: Carmello and Leslie (ages 34 and 35,