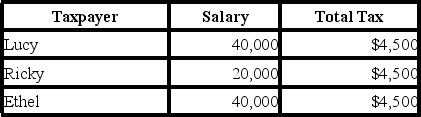

Consider the following tax rate structures. Is it horizontally equitable? Why or why not? Is it vertically equitable? Why or why not?

Definitions:

Medicare Tax

A tax that funds Medicare, a U.S. government health insurance program for individuals aged 65 and over or with certain disabilities.

Direct Tax

is a type of tax directly imposed on individuals or entities, such as income tax and property tax, which cannot be passed onto others.

Payroll Tax

Charges levied on both employers and employees, typically based on a proportion of the wages that businesses distribute to their workers.

Wage Base

The maximum amount of earnings that is subjected to certain taxes, such as Social Security taxes, within a given time period.

Q14: Bert owns a company that provides institutional

Q17: Dynamic forecasting does not take into consideration

Q35: Kent and his wife recently adopted a

Q43: Doug's company allows him to purchase its

Q82: Kevin is the financial manager of Levingston

Q84: The California Nurses Association was formed to

Q91: Natalia is a new employee in the

Q94: Leonardo, who is married but files separately,

Q95: Irene manages bakers who work for a

Q108: Manny, a single taxpayer, earns $65,000 per