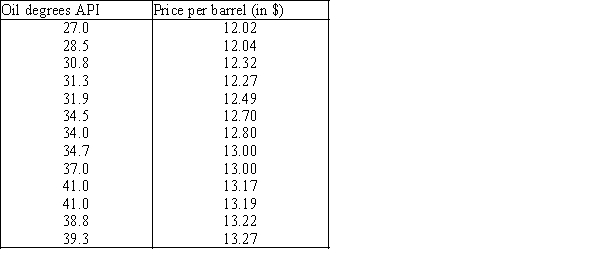

Oil Quality and Price

Quality of oil is measured in API gravity degrees--the higher the degrees API,the higher the quality.The table shown below is produced by an expert in the field who believes that there is a relationship between quality and price per barrel.  A partial Minitab output follows: Descriptive Statistics Variable N Mean StDev SE Mean Degrees 13 34.60 4.613 1.280 Price 13 12.730 0.457 0.127 Covariances Degrees Price Degrees 21.281667 Price 2.026750 0.208833 Regression Analysis Predictor Coef StDev T P Constant 9.4349 0.2867 32.91 0.000 Degrees 0.095235 0.008220 11.59 0.000 S = 0.1314 R−Sq = 92.46% R−Sq(adj)= 91.7% Analysis of Variance Source DF SS MS F P Regression 1 2.3162 2.3162 134.24 0.000 Residual Error 11 0.1898 0.0173 Total 12 2.5060

A partial Minitab output follows: Descriptive Statistics Variable N Mean StDev SE Mean Degrees 13 34.60 4.613 1.280 Price 13 12.730 0.457 0.127 Covariances Degrees Price Degrees 21.281667 Price 2.026750 0.208833 Regression Analysis Predictor Coef StDev T P Constant 9.4349 0.2867 32.91 0.000 Degrees 0.095235 0.008220 11.59 0.000 S = 0.1314 R−Sq = 92.46% R−Sq(adj)= 91.7% Analysis of Variance Source DF SS MS F P Regression 1 2.3162 2.3162 134.24 0.000 Residual Error 11 0.1898 0.0173 Total 12 2.5060

-{Oil Quality and Price Narrative} Use the predicted values and the actual values of y to calculate the residuals.

Definitions:

Cost of Retained Earnings

The opportunity cost for shareholders for having the company retain the earnings instead of distributing them, often considered in investment and dividend decisions.

Risk Free Rate

The theoretical rate of return of an investment with zero risk of financial loss, often represented by the yield on government bonds.

Beta

A measure of a stock's volatility in relation to the overall market; a beta greater than one indicates higher than market volatility.

Flotation Costs

Expenses incurred by a company in issuing new securities, including underwriting, legal, and registration fees, reiterating the cost aspect of raising equity or debt.

Q4: Jane has a freelance writing business and

Q13: In one-way analysis of variance, between-treatments variation

Q30: Which of the following statements is TRUE

Q50: Competition affects companies in all of the

Q58: {Student's Final Grade Narrative} Does this data

Q68: In one-way ANOVA, the total variation SS(Total)

Q86: _ is the practice of shifting work

Q114: A multiple regression is called "multiple" because

Q157: The test statistic for the chi-squared test

Q228: {Allman Brothers Concert Narrative} Estimate the number