Oil Quality and Price

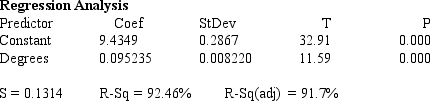

Quality of oil is measured in API gravity degrees--the higher the degrees API,the higher the quality.The table shown below is produced by an expert in the field who believes that there is a relationship between quality and price per barrel.

A partial Minitab output follows:

-If there is no linear relationship between two variables x and y,the coefficient of determination must be -1.0.

Definitions:

Population Parameter

A numerical value that describes a characteristic of an entire population, such as the mean or standard deviation.

Point Estimate

A single value given as the best guess or estimate of a population parameter based on sample data.

Interval Estimate

An interval estimate is a range of values derived from sample statistics that is likely to contain the value of an unknown population parameter.

Population Parameter

A numerical value summarizing the entire population that can often be estimated by a statistic derived from a sample.

Q22: The degrees of freedom for the test

Q29: What technology will not benefit offshoring?<br>A)FTP<br>B)VOIP<br>C)LAN<br>D)WAN

Q29: A multiple regression model has the form

Q31: A sports preference poll showed the following

Q92: In calculating the standard error of the

Q165: {Game Winnings & Education Narrative} Use the

Q197: {Comedy Shows Revenues Narrative} Use the regression

Q207: {Income and Education Narrative} Determine the least

Q227: A regression analysis between sales (in $1000)

Q253: The probability distribution of the error variable