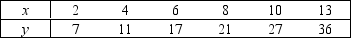

Consider the following data values of variables x and y.

a.

Calculate the coefficient of determination, and describe what this statistic tells you about the relationship between the two variables.

b.

Calculate the Pearson coefficient of correlation.What sign does it have? Why?

c.

What does the coefficient of correlation calculated tell you about the direction and strength of the relationship between the two variables?

Definitions:

CAL

Stands for Capital Allocation Line, which represents the risk-reward profile of various portfolios, showing the possible rates of return for a given level of risk.

1-month T-bills

Short-term U.S. government debt obligations with a maturity of one month, often used as an investment with minimal risk.

Compound Return

The increase in value of an investment due to the earnings on both the principal and the accumulated earnings over previous periods.

Portfolio

A portfolio is a collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including mutual, exchange-traded, and closed funds.

Q47: A multiple regression analysis involving three independent

Q54: Two measurements from the same individuals is

Q60: {Oil Quality and Price Narrative} Use the

Q73: A chi-squared test of a contingency table

Q94: {Real Estate Builder Narrative} Which of the

Q112: In a multiple regression model, the mean

Q112: A chi-squared goodness-of-fit test is always conducted

Q135: If the Durbin-Watson statistic has a value

Q142: {Real Estate Builder Narrative} Which of

Q172: To test for normality, the _ hypothesis